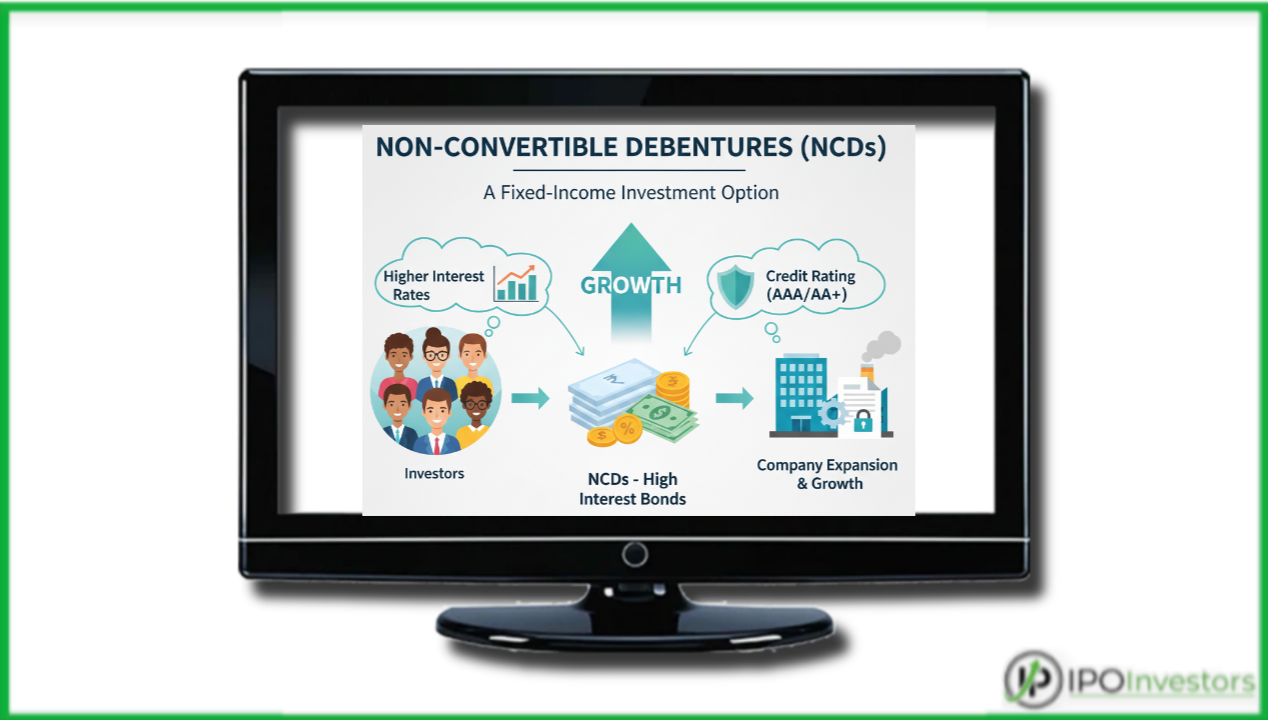

This section provides detailed information about all current and upcoming NCD issues in 2026, helping investors stay updated on new opportunities in the debt market. Non-Convertible Debentures (NCDs) are a popular fund-raising instrument used by companies to mobilize capital from the public through structured issues, similar to equity offerings but with different risk and return characteristics.

The full form of NCD is Non-Convertible Debenture, which is essentially a type of corporate bond that cannot be converted into equity shares. Companies issue NCDs to raise long-term funds without diluting ownership. These instruments are generally considered relatively safe, especially when issued by financially stable companies, as they offer predictable returns.

Unlike equity instruments, NCDs function as a loan taken by the company from investors. When a company raises money through NCDs, it is legally obligated to pay interest on the borrowed amount. This interest is paid at a pre-decided rate, making NCDs attractive to investors who prefer stable and fixed income over market-linked returns.

One of the key features of NCDs is their fixed maturity period. At the end of this tenure, investors receive their principal amount along with the promised interest. Because of this fixed return structure, NCDs are often compared to traditional fixed-income products, though they usually offer higher returns than bank fixed deposits, depending on the credit rating of the issuer.

Although NCDs and IPOs are both used by companies to raise funds from the public, they are fundamentally different. An IPO provides ownership in the company and returns depend on market performance, whereas NCDs do not offer ownership and provide fixed interest-based returns. This distinction makes NCDs suitable for investors seeking regular income with comparatively lower risk.

Current & Upcoming NCD Issue 2026

| Company | Open | Close | Rating |

|---|---|---|---|

| Adani Enterprises Limited | Jan 06 | Jan 19 | CARE Ratings Limited: AA- ICRA Limited: AA- |

What is an NCD?

NCD full form is Non-Convertible Debenture. It is a type of financial instrument used by companies to raise long-term funds from the public. These are debt instruments, meaning the investor is essentially lending money to the company for a fixed period at a pre-decided interest rate.

Read Also: Upcoming IPO (MainBoard IPO) & Current IPO List In India 2026

The term non-convertible means that these debentures cannot be converted into equity shares of the issuing company at any point in time. Instead, the company promises to repay the principal along with interest on the maturity date.

Why Do Companies Issue NCD?

Companies issue NCD to meet various financial needs like:

- Expanding their business operations

- Repaying existing debts

- Funding working capital requirements

- Financing infrastructure projects

Instead of borrowing from banks at high-interest rates, companies raise money directly from investors by offering attractive interest rates through NCD.

Types of NCD

There are primarily two types of NCD:

- Secured NCD: These are backed by the company’s assets. In case the company fails to repay, investors can claim compensation from those assets. Hence, they are considered safer.

- Unsecured NCD: These are not backed by any collateral. They carry higher risk, but also offer higher returns to compensate for the risk.

Key Features of NCD

- Fixed Interest Rates: NCD come with pre-defined interest rates (also known as coupon rates) which are usually higher than traditional savings instruments.

- Tenure: Usually ranges between 1 to 10 years.

- Liquidity: Most NCD are listed on stock exchanges, allowing investors to buy/sell them before maturity.

- Credit Rating: NCD are rated by agencies like CRISIL, CARE, or ICRA, which indicate the creditworthiness of the issuer.

- Taxation: Interest earned is taxable as per your income tax slab.

Who Should Invest in NCD?

NCD are ideal for:

- Investors seeking fixed income with higher returns than bank FD.

- Those who can hold till maturity to earn stable interest.

- Investors who are comfortable with moderate risk (especially with unsecured NCD).

- Individuals looking to diversify their debt portfolio.

Risks Involved in NCD Investment

Though NCD offer attractive returns, they come with certain risks:

- Credit Risk: If the company defaults, your principal and interest are at risk.

- Liquidity Risk: If listed NCD don’t have active buyers in the market, selling before maturity could be difficult.

- Interest Rate Risk: If market interest rates rise, your fixed-rate NCD may look less attractive.

How to Invest in NCD?

You can invest in NCDs through:

- Public Issues: Companies open NCD issues for subscription through platforms like NSE, BSE, or your stockbroker.

- Secondary Market: Already issued NCDs can be bought or sold via stock exchanges.

To invest, you need:

- A Demat Account

- PAN and KYC-compliant details

- Sufficient funds in your bank account

Important Things to Check Before Investing

- Credit Rating of the NCD

- Issuer’s past financial performance

- Coupon Rate and Payout Frequency

- Lock-in Period or Early Exit Option

- Listing Details (NSE/BSE)

With interest rates stabilizing and investors looking for safer alternatives to equity, NCD are becoming a preferred choice, especially among senior citizens and conservative investors. Many reputed NBFCs and corporates are regularly launching NCD with appealing interest rates.

NCDs can be a smart choice for investors who are looking for predictable returns with relatively lower risk than equity. However, like any financial product, they require careful evaluation. Always read the offer document, assess the issuing company’s credibility, and consider your own financial goals before investing.

If you’re planning to diversify your investment portfolio and add a stable income-generating instrument, NCD are definitely worth considering.

This content has been researched and written by the IPO Investors Team…

Disclaimer: Readers are strongly advised to seek guidance from a qualified financial advisor before making any investment decisions. Relying solely on the content presented here for financial choices is done entirely at the reader’s own risk.

| Thank You… |

|---|